Nine’s thought leadership and insights series, State of the Nation, dissects the state of play across key categories challenging marketers right now. For this first look at the Retail sector, we delve deeper into the now, new and next of for Retail, shining a spotlight on the challenges and opportunities moving forward.

Of the

who have switched to a different brand, price was cited as the deciding factor for more than half.

With

Australians selecting price as the #1 factor of 27 that determine their choice of retailer.

But range, convenience and quality experience also come into play.

Source: Fifth Dimension’s Bespoke Survey. The Australian Retail Report 2023 - Shopify

Whilst price is ranked as the number one influence on people's purchasing decisions, Australian consumers fired clear warning shots about how strongly they feel about the quality of experience.

Post-pandemic, we know consumers are shopping online more than three years ago. And by 2024, spending in e-commerce is expected to reach over $32 billion in Australia.

Returned inventory creates 44 million tons of landfill each year. As financial burden to retailers mounts up, solutions like made-to-order manufacturing, AR clothing try-ones, and smarter demand forecasting are reducing excess inventory.

Free returns

Better security

Using data responsibly

And more...

Source: Sydney Morning Herald, 22 March. The Drum, March 2023. Wunderman Thompson Future Shopper Report 2023

Social media has played a critical role in the compression of the traditional marketing funnel, where the points of inspiration and purchase have converged.

“Compressed commerce” is being driven by a need for “efficiency” and “ease”.

55% of Australian online shoppers want to get from inspiration to purchase as quickly as possible

Source: Wunderman Thompson Future Shopper Report 2023

Touchpoints are proliferating, and in some cases converging.

Consumers are constantly using both physical and digital channels in combination.

of consumers research their purchases online before they buy them in-store.

Source: Wunderman Thompson Future Shopper Report 2023

Only 27% of Australian retailers are prioritising omnichannel data integration, and only 14% are investing in an omnichannel strategy.

More than 1 in 2 Australians want a seamless experience across all channels.

This increases to 63% for Generation X, Y and Z Australians.

Source: Nine’s Bespoke Survey via Idea Exchange

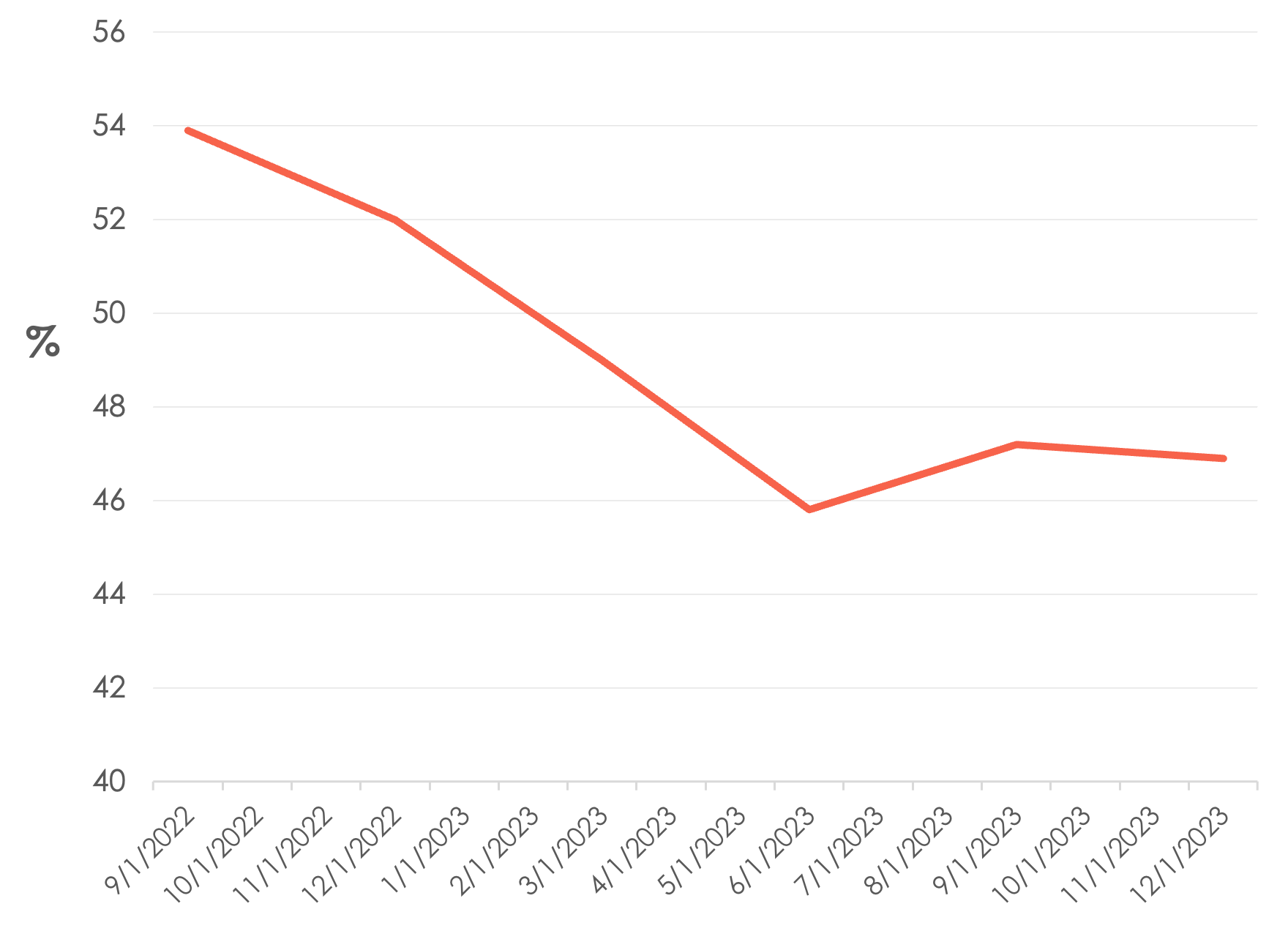

The percentage of Australian consumers who are ‘happy to spend more on sustainable goods’ has dropped 7 percentage points in the past 18 months.

Increasingly, Australians are being forced to weigh up the costs to the planet with the cost of living.

“I’m happy to spend more on goods that are sustainable”

Source: Nine’s Consumer Pulse

The complex purchasing journey means retailers have to work harder than ever to acquire and retain customers.

Of the 46% of Australians who have tried a different brand, 86% intend to continue with that brand.

9 out of 10 Australians participate in one or multiple loyalty programs.

Source: Shoppify

Keep it clear.

of global consumers think brands should be transparent about their commitments and promises.