The Rise of the Super Consumer

Over 50s have all the money – but advertisers and algorithms are getting them all wrong: Russel Howcroft, Chris Colter, Mitesh Khatri and Lisa Day on how to fix it

There’s a stream of research that shows Australians over 50 are spending big despite interest rate hikes, while younger people are tightening their belts. But marketers, agencies, media and targeting algorithms are largely getting the over 50s all wrong – and missing immediate growth opportunities. Time for a rethink, say Nine, Initiative and GfK.

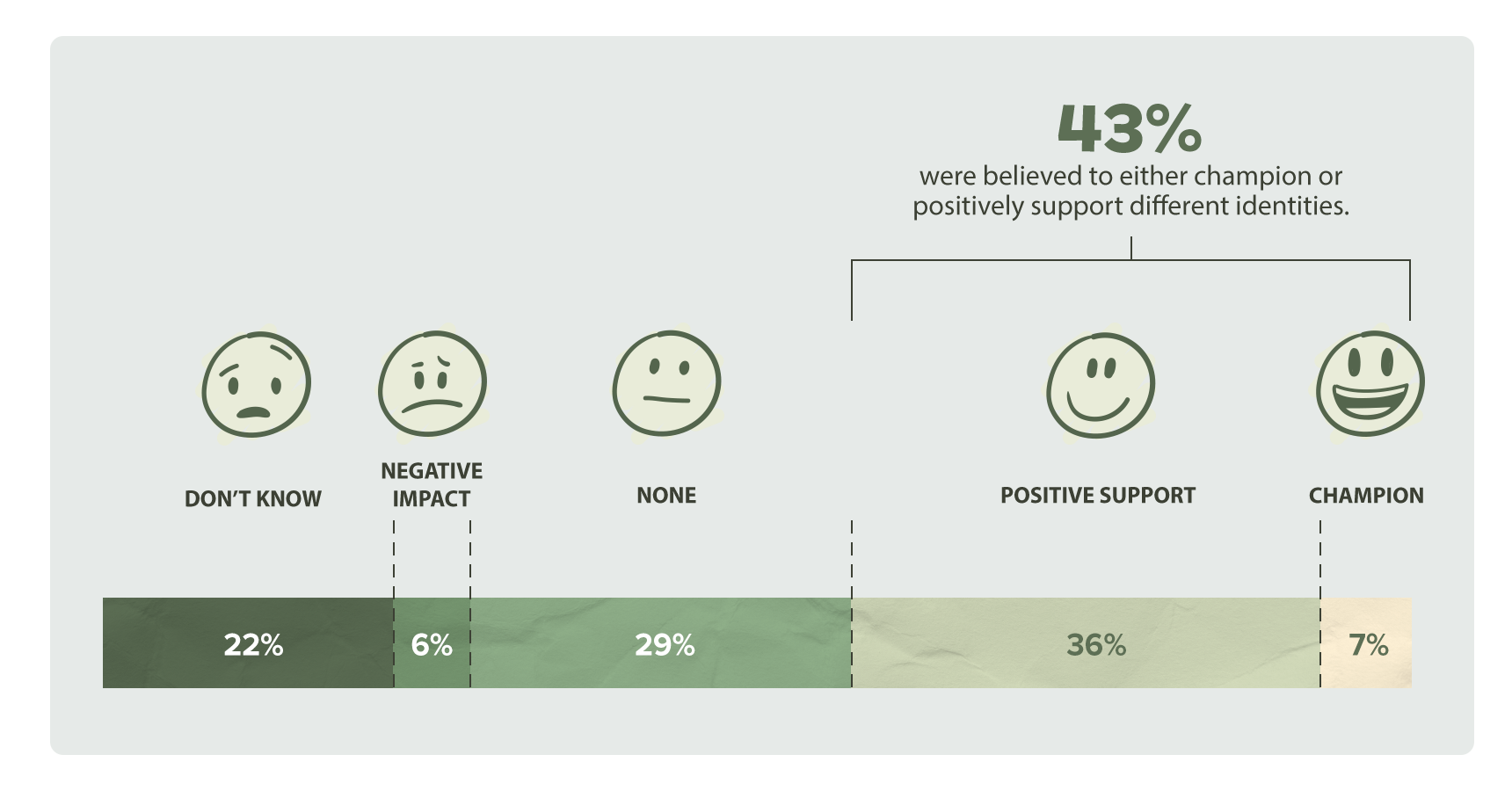

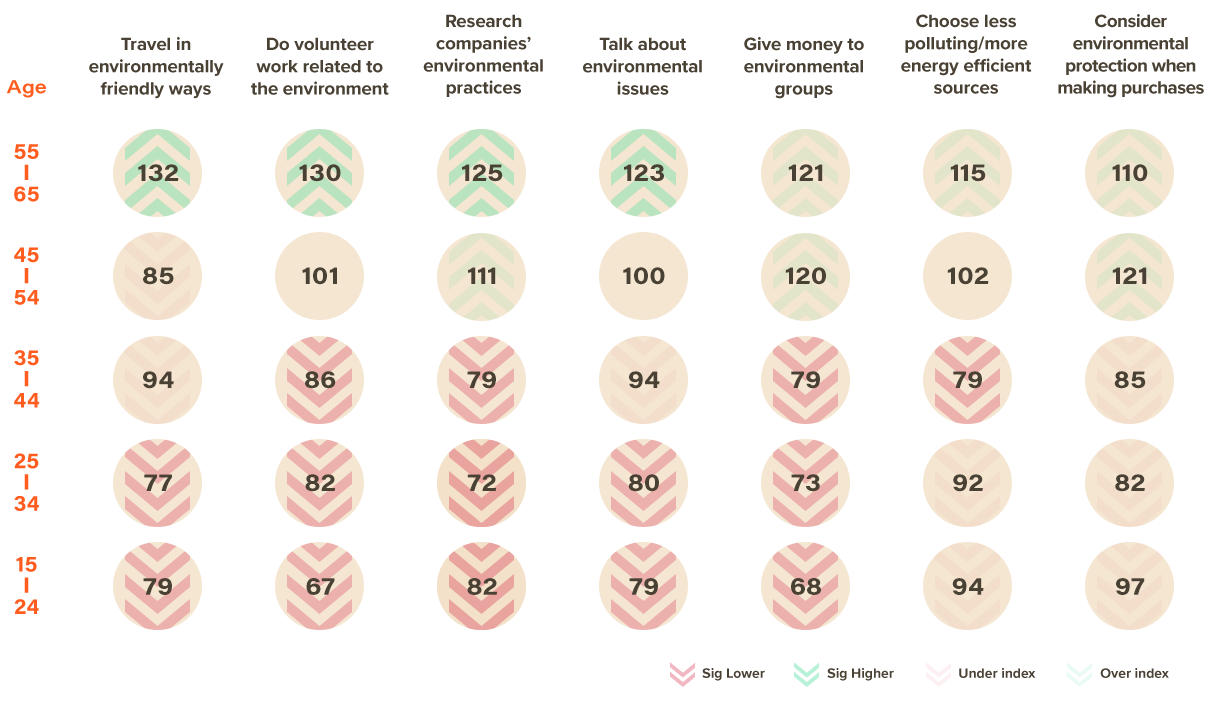

Marketers are increasingly focused on reaching influencers. The problem is, many are targeting the wrong ones. An increasing body of evidence underlines the fact that Australians aged 55-plus now hold the greatest influence – and buying power –with discretionary spending outstripping inflation.

For younger people, the reverse is true. Research by Nine and GfK finds that the spending divide between younger and older Australians is widening as the highest interest rates in 30 years bite hard.

Other researchers are drawing the same conclusions. Latest Commbank analysis of seven million customer accounts across 360 spending categories finds exactly the same thing.

That shift has significant implications for brands and their marketing strategies – as unpacked at this month’s Big Ideas Store by 3AW Breakfast host and advertising guru Russel Howcroft, Initiative’s Chris Colter, GfK’s Mitesh Khatri, Powered by Nine’s Lisa Day and Nine’s Ash Earnshaw.

About to get richer

A large number of Australians in their mid-50s to 60 already have significant discretionary spend. Their kids have left home, and per Russel Howcroft, they will soon command even greater financial firepower, given their early boomer” parents are “entering their twilight years”. Kids gone and incoming inheritance “puts them in the sweetest of consumer spots”, says Howcroft. And that’s before downsizing homes is factored in. Plus, after decades spending the bulk of their incomes raising a family, many are now spending it on themselves.

“People used to say life begins at 40,” said Howcroft. “Life is now beginning at 55.”

Powered by Nine’s Lisa Day underlined that point.

“It’s a sobering fact, but 80 per cent of Australian wealth is held by 41 per cent of the population who are 45 years-plus,” said Day. Marketers not fully focused on those who are middle-aged and upwards are therefore targeting just one-fifth of the total addressable market in financial terms.

Commbank’s findings that people aged over 50 are outspending inflation is unsurprising, since half of that cohort “have paid off their mortgage, and a quarter of them have an investment property”, added Day. “So, they have more assets than liabilities. They’ve got bigger savings. They can weather this [inflationary pressure]. They’re out spending because they have a buffer – which younger audiences simply don’t have.”

Most powerful influencers

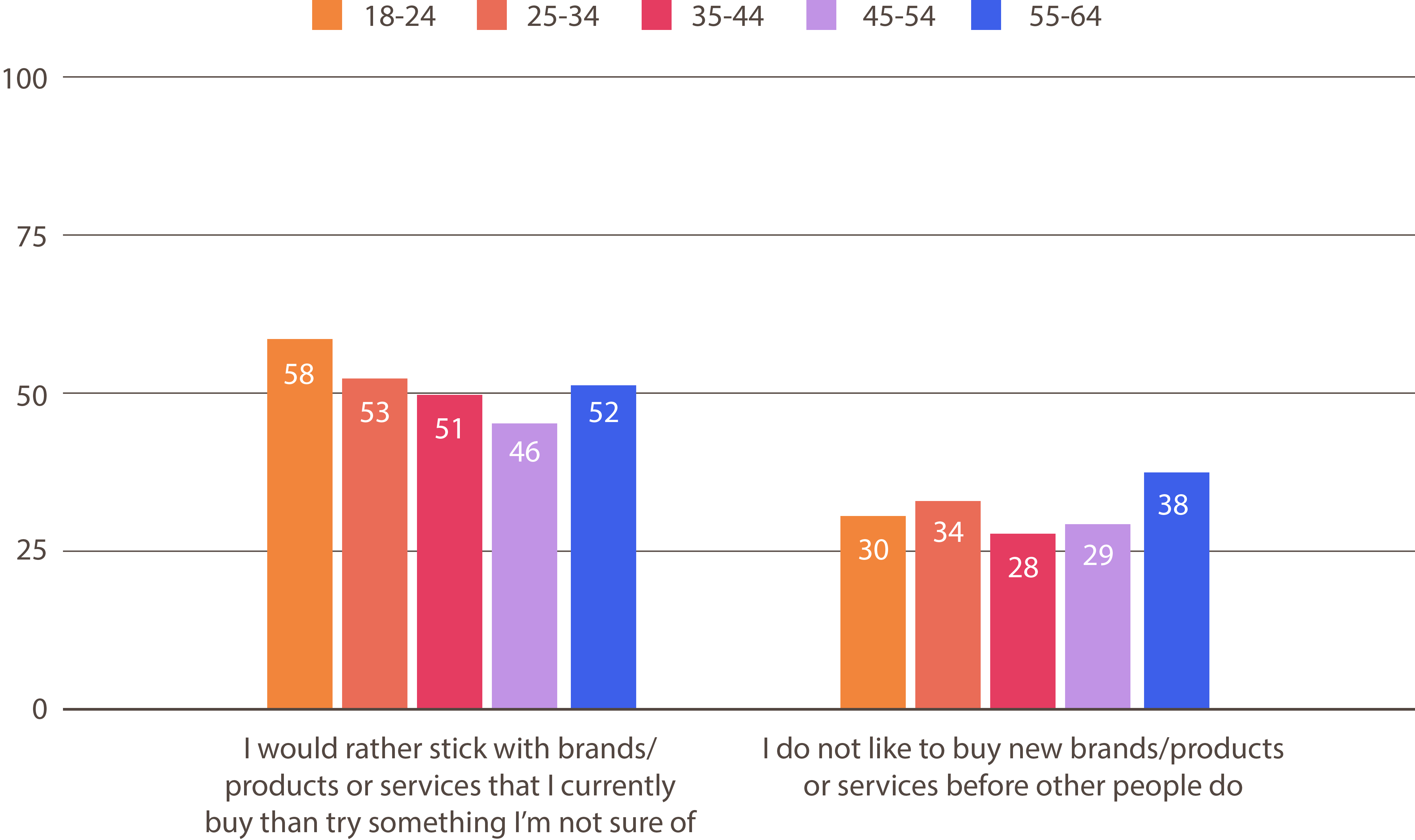

The Nine and GfK research makes a case for Australia’s middle-aged cohort to actually be more powerful influencers than some of the younger social media influencers paid by brands to push products. It found strong brand loyalty amongst 45-64-year-olds – which has network effects, with two in five stating that they are involved in the purchase of products for family and friends, and a third stating that they actively talk about experiences they’ve had with brands.

Rethinking 'lazy' planning, ads

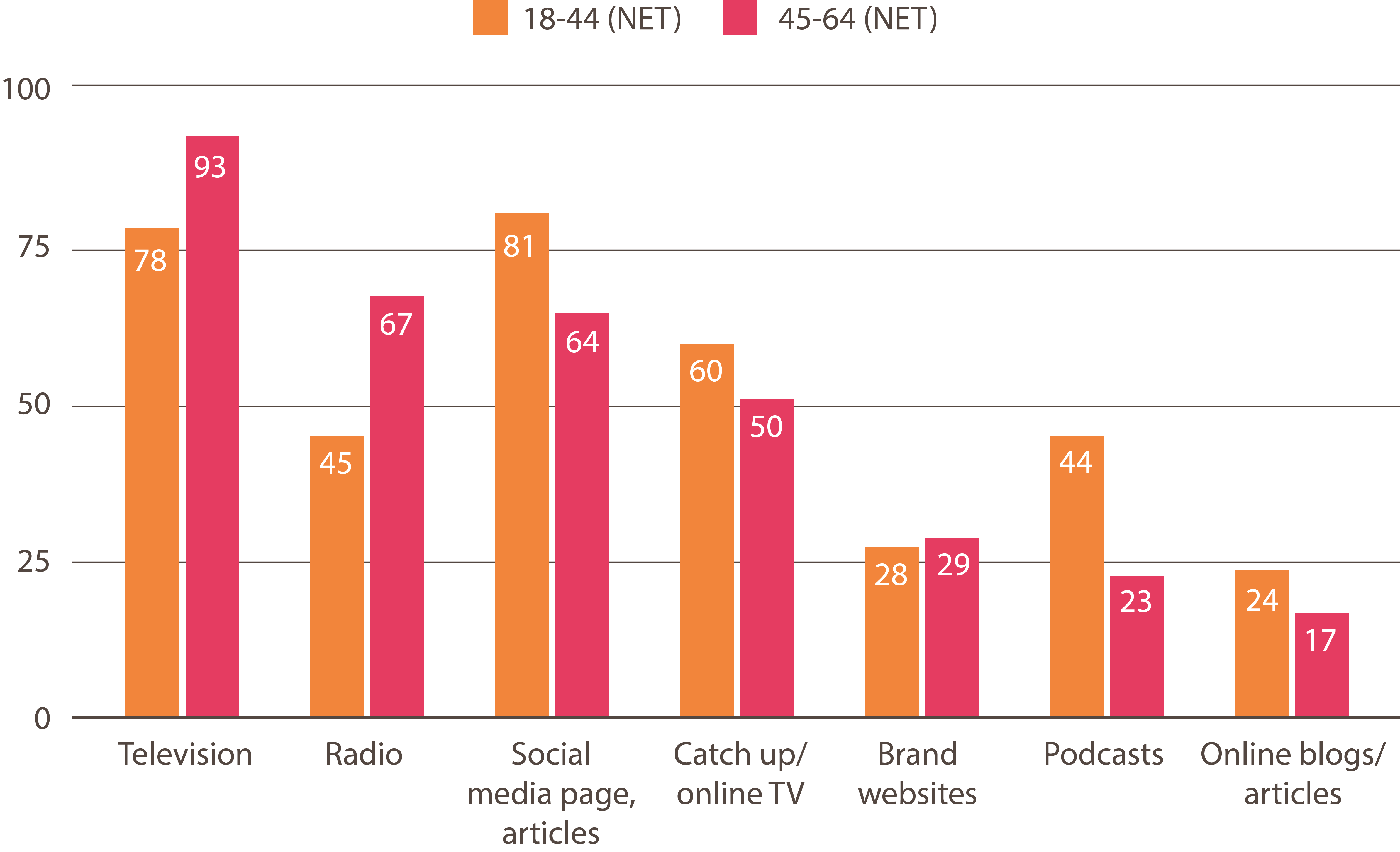

The research also found people on average see themselves as seven years younger than they actually are. Plus, most are tech savvy, have broad media consumption and do a tonne of research before making a purchase of any significance. Which means that just sticking an old person in an ad is a bit of a miss, per Initiative’s Chris Colter.

“Marketers with a myopic view tend to just go, ‘Oh well, I need to show someone with white hair if I’m targeting that audience’, and I think that that’s a mistake,” Colter said.

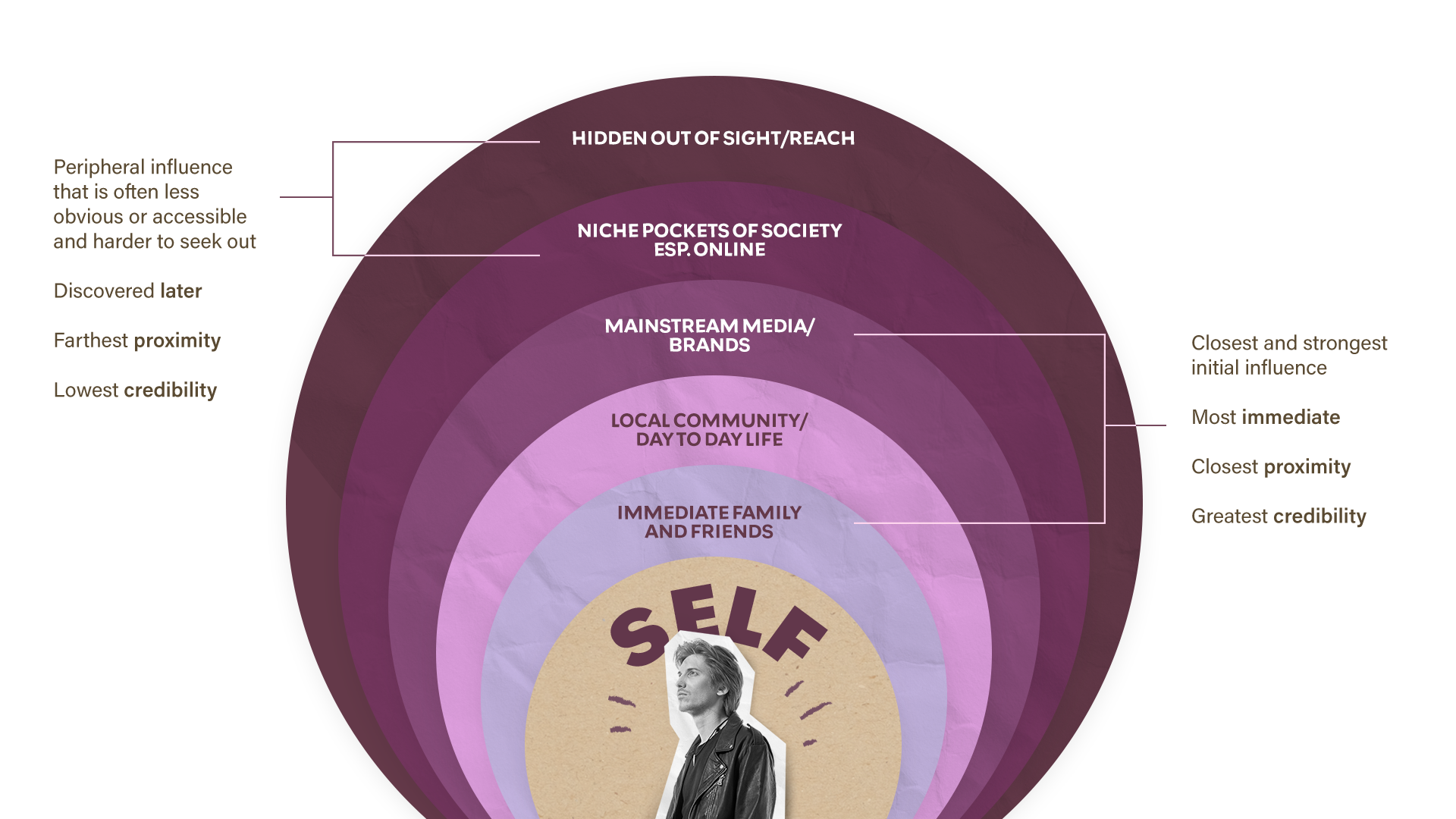

He thinks planning as a whole should take into account that age can be largely immaterial to interests and cautioned against targeting too narrowly on that basis. Plus, he warned that algorithmic targeting can be just as guilty of unconscious bias.

Colter cited Initiative research for a finance brand as an example.

“We do a lot of digital twinning as one of our research methodologies – basically a fancy way of saying that we create fake social profiles and watch what the algorithm serves them.”

In one instance, Initiative created two profiles with 'attitudinally identical' characteristics, but set one profile’s age as 24 and one at 57.

“We just changed the age. But one was served almost exclusively with retirement ads, funeral insurance and anti-wrinkle cream. The other was served travel ads,” said Colter. “So I think we need to do better as an industry at tackling some of the algorithmic bias before we lean into some of that targeting. And also in thinking how we approach these audiences in more mass broadcast environments so that we’re resetting that norm as well.”

Howcroft agreed: “We need to be sophisticated in how we go about execution to this really wealthy cohort.” He thinks the media industry might need to rethink how it packages audience demographics.

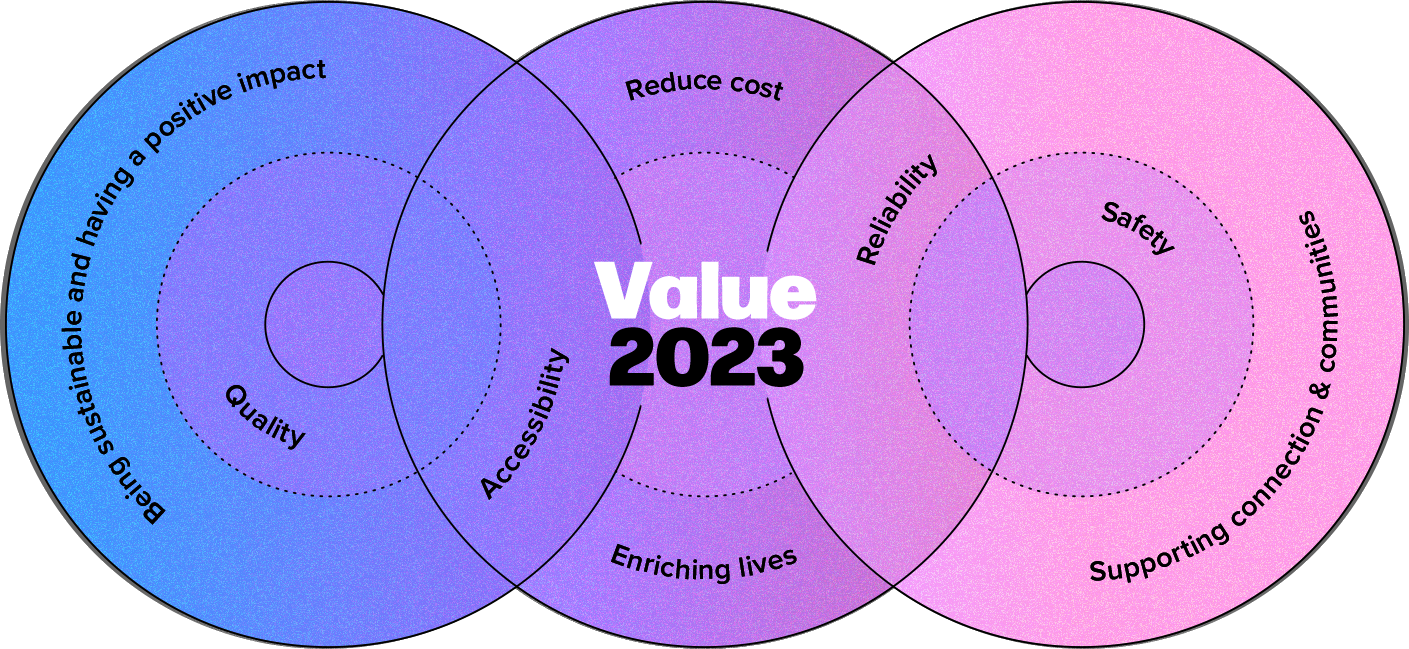

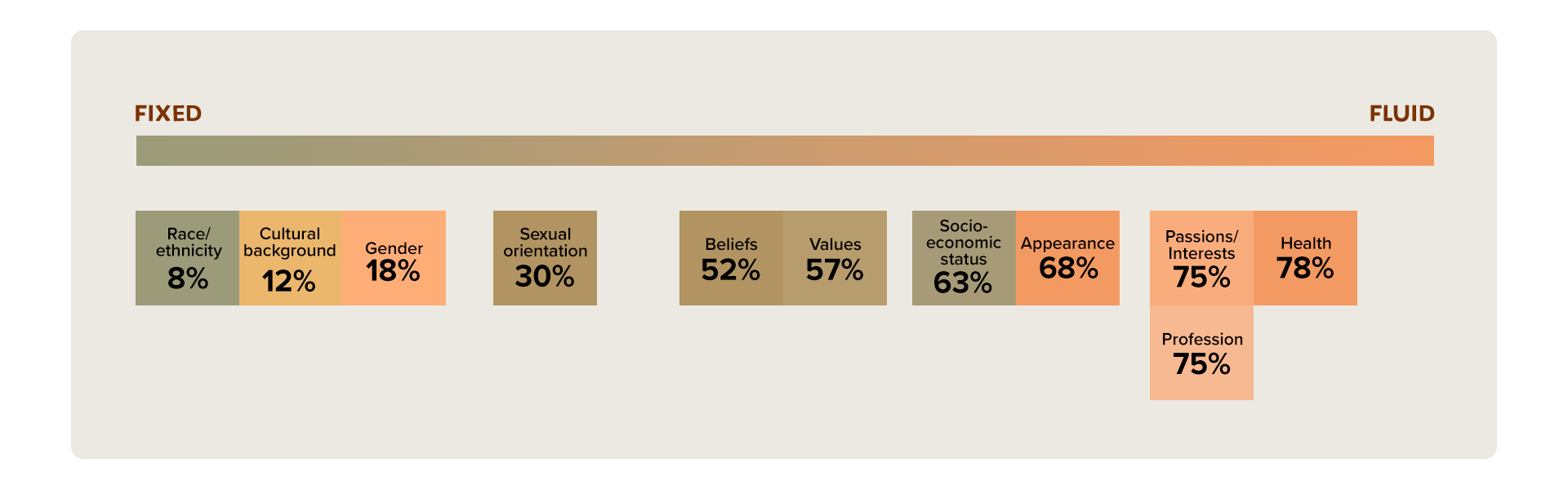

“I’ve often thought that demography [based on] age brackets is a bit of a nonsense in a way. Rather than cutting people vertically, if we just go by – let’s call it values and attitudes – you’re going to find a lot of commonality no matter what the age.”

Should that shift occur, some planners would welcome it. “I genuinely think we should be progressing marketers towards psychographics over demographics,” Initiative’s Colter says. Either way, “I think making sure you’re matching psychographics with demographics is super important.”

Target today's buyers over tomorrow's

Nailing planning and creative to more effectively target older audiences will drive immediate growth, said GFK’s Mitesh Khatri, which marketers are under acute pressure to deliver.

“We see a lot of brands targeting the recruitment [of new customers] for tomorrow and the focus on younger age groups. That’s never going to go away, but I think the research clearly shows where the dollars are right now” Mitesh says.

“Where’s the spending happening and are we overlooking this audience? I think it gets overlooked too much because too many brands come to us saying, ‘We want to target the next recruitment into our brand,’ and a lot of those brand targets are sitting at that 25-to-40 age group or younger” he added.

He thinks there is an opportunity to change “marketing’s view, society’s view, perhaps government’s view of how we look and treat this audience”.

“There’s a huge opportunity to step outside the box, look at the attitudes, look at how they think about life, their values. They want to enjoy it and connect on a deeper, more meaningful level beyond age.”

In the meantime, Powered’s Lisa Day has a simple tip for advertisers rethinking their approaches to over-50s.

“People think and feel younger than they actually are. If you're an advertiser, don't be conservative in your tone or use of images. Pitch younger, more youthful and you'll be surprised how well you'll do" said Day.

View more marketing insights from Powered By Nine

Contact us for more information on how your brand can leverage the power of Nine to deliver real business outcomes.