CONSUMER PULSE

We are living in uncertain times, but one thing is certain; the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys (conducted weekly) and deeper dive surveys (conducted monthly) with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 9 - commencing 18th May 2020

Headline Sentiments

“Mixed feelings as we change again!”

“I’m proud of Australia's response and result so far”

“I’m concerned about the impact of returning to "business as usual" on society, personal wellbeing, mental health and the natural environment”

Macro themes

Familiar sights

Australia is beginning to consider life ‘on the other side’, with occasional glimpses of familiarity.

Brand implication

During this transition phase brands need to communicate in a transparent manner, supporting consumers to return to familiar purchasing behaviours with greater flexibility.

Well beings

Increased movement brings a renewed focus on wellbeing, as physical and mental health come into focus.

Brand implication

Brands must look to how they as a good corporate citizen can help support their customers during this time.

The bigger picture

As the immediacy of Australia’s crisis starts to fade, attention is turning back to pre-COVID concerns of climate change and sustainability.

Brand implication

Corporate social responsibility will continue to be under the spotlight as consumers further question the actions of business in creating a more positive future post-covid.

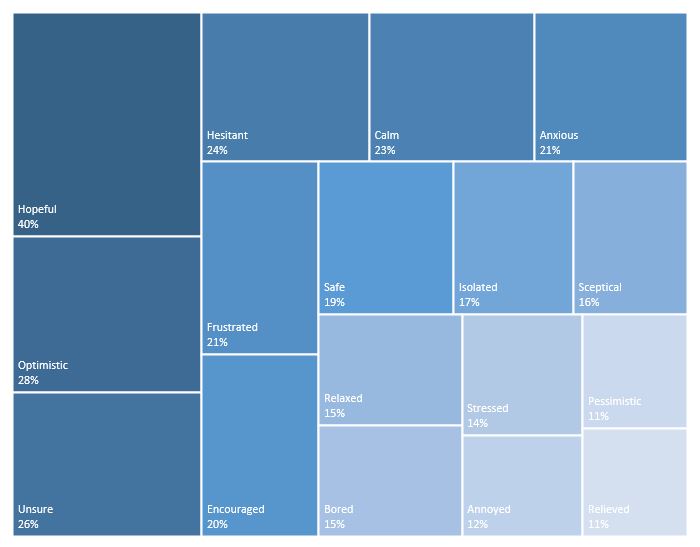

Mood tracker - steadying the ship

After a minor wobble last week the mood has steadied: hope and optimism are again ascendant, levels of concern have plateaued. The easing of restrictions is bringing some relief and the mood tracker sees ‘isolation’ and ‘boredom’ in sharp decline. However there is also an underlying current of uncertainty with marked increases in those feeling ‘hesitant’ and ‘unsure’. Audience concerns are shifting towards the mental health impacts of preceding weeks and in times ahead.

% who are ‘Very/Extremely Concerned’

NOTE: For the best viewing experience on mobile, please view landscape.

Positive vs negative emotions

NOTE: For the best viewing experience on mobile, please view landscape.

Shifting activities and consumer spend

Australian life is beginning to transition to more familiar patterns – with exercise and driving moving up the list of activities, and hobbies starting to slip down the list. Consumer spend is starting to shift too, with categories such as fashion and health supplements moving up the list of priorities.

% who are doing activities ‘more than last week’

NOTE: For the best viewing experience on mobile, please view landscape.

% who spent more per category compared to last week

NOTE: For the best viewing experience on mobile, please view landscape.

The return of sport

As sport gradually begins returning to screens around the world, we explored Nine audience sentiments on live Australian sports. Many have been feeling its absence, especially:

- Males – 57% miss live Australian sport, 23% miss it ‘a lot’

- Financial Review readers – 56% miss live Australian sport, 21% ‘a lot’

- 9Nation audiences – 50% miss live Australian sport, 18% ‘a lot’

- Younger viewers – 51% of 18-34s and 35-54s respectively miss live sport

Nine’s youngest audiences are most excited about the return of NRL - among 18-34s:

- 1 in 3 are extremely happy about the return of the NRL

- 14% are more likely to watch NRL than they were pre-COVID

% missing live Australia sport

NOTE: For the best viewing experience on mobile, please view landscape.

Category focus: Money and finance

Against a backdrop of economic upheaval, Nine’s audiences have been seeking out money news, information and advice.

87% of Financial Review readers

75% of SMH/The Age readers

65% of 9Nation audiences

are seeking financial content as much or more than they did pre-COVID.

Financial Review readers are engaging with a wide range of topics, especially shares (60%), superannuation (36%), property investments (29%), financial advice (22%), how to invest (18%), income tax (17%), banking (17%), saving (15%), managed funds (12%), managing debt (12%), budgeting (11%) and insurance (10%).

SMH/The Age readers are seeking content on superannuation (35%), shares (30%), financial advice (18%), banking (15%), property investments (14%), saving (13%) and income tax (10%).

9Nation audiences are seeking content on on superannuation (28%), shares (22%), saving (22%), banking (19%), financial advice (17%), budgeting (16%) and property investments (11%).

Finance content interests by audience

NOTE: For the best viewing experience on mobile, please view landscape.

Money and finance: Information needs across age groups

All age groups are engaging with financial content, however a high proportion of younger audiences are seeking it out moreso than pre-COVID.

32% of 18-34s

27% of 35-54s

28% of 55+s

are seeking financial content information more than they did pre-COVID.

18-34s’ top interests include content on saving (44%), budgeting (37%), shares (30%), superannuation (26%) and financial advice (26%).

35-54s’ top interests are superannuation (29%), shares (27%), banking (21%), property investments (18%) and saving (16%).

55+s’ top interests are superannuation (37%), shares (32%), financial advice (19%), banking (13%) and property investments (13%).

Finance content interests by age group

NOTE: For the best viewing experience on mobile, please view landscape.

Finance content interests by gender

Men and women have different interests too. Men indicate interest in wider range of topics overall, and are much more likely to see out content about shares (37% vs 22% of females), superannuation (37% vs 30%) and banking (19% vs 12%); women are much more likely to seek content about budgeting (13% vs 7%).

Top finance content topics by gender

NOTE: For the best viewing experience on mobile, please view landscape.

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.