CONSUMER PULSE

We are living in uncertain times, but one thing is certain; the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys (conducted weekly) and deeper dive surveys (conducted monthly) with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 8 - commencing 4th May 2020

Headline Sentiments

“I’m excited at the prospect of social improvement”

“I feel lucky in a personal sense, but worried from a broader community perspective”

“I’m concerned about the unknown future, what a second wave will look like”

“I’m concerned that we'll be pushed out of restrictions before it's safe”

Macro themes

Easy does it

As restrictions begin to ease there is excitement for some, but fear of change for others. The next phase of changes bring uncertainty and ambiguity.

Brand implication

Help support a sense of calm through the transition, change at the right pace, provide a vision of better times ahead.

Transformation

Far from a return to business as usual, life and business are transforming and taking new direction.

Brand implication

Opportunity to innovate, evolve, reinvent to offer a better customer experience via all brand touch points from service to product.

Improvement

Consumers want to leave the bad behind and keep hold of the good.

Brand implication

Brands have an opportunity to go on a journey of improvement with consumers, supercharging their corporate social responsibility as a vital component of business strategy.

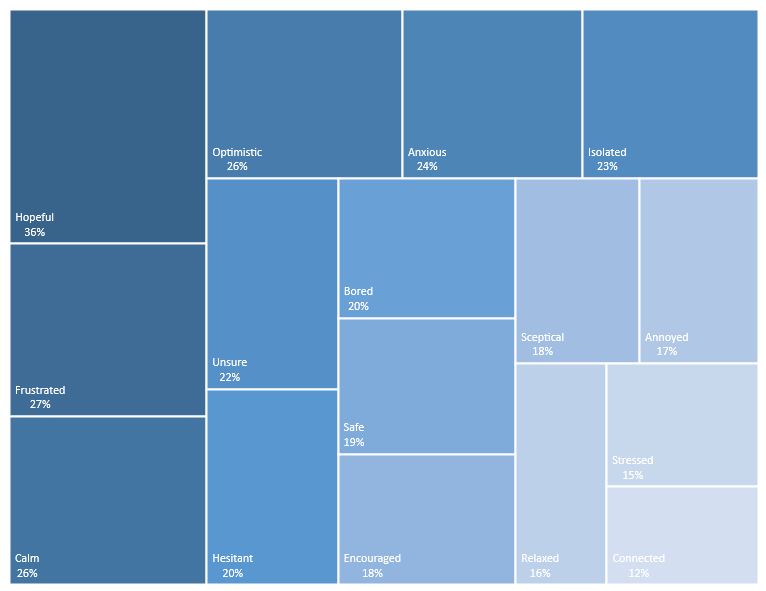

Mood tracker - apprehension about the next phase

The prospect of easing restrictions is shifting the mood this week. Positive emotions such as hope, calm and optimism are still dominant, but scepticism, hesitation, annoyance and frustration are growing. While, for five consecutive weeks there has been a downward trend in those feeling ‘very/extremely concerned’, this week the trend has flattened.

Audiences worry about a number of factors, including the prospect of a second wave of infections, inadequate testing to ensure the safety of easing restrictions, the onset of winter and increased illnesses in the community, unease with growing complacency about social distancing, distrust in government, and underlying stress of managing financial, family and work pressures at home.

“Fear of people. I want to see people/friends but find I am hesitant to do so. Been like this for about a week now.”

“I’m working more from home and finding it hard to switch off. Also daycare has had to cut hours which is placing stress on my ability to work/get things done”

% who are ‘Very/Extremely Concerned’

NOTE: For the best viewing experience on mobile, please view landscape.

The impact of driving

With easing restrictions audiences are beginning to return to the road, with mixed emotions. While many were happy about the freedom (particularly Financial Review readers), there was concern about the implications of increased movement for spread of the virus, the return to traffic and environmental impacts of cars on the road. One in four felt indifferent, or the same way they’d felt before.

“I was never especially worried about car travel as a contributing factor to covid spread, but I worry that car travel will lead to other activities that may contribute to covid spread”

NOTE: For the best viewing experience on mobile, please view landscape.

Activities and consumer spending

Despite uncertainties about increased movement and social interactions outside the home, audience activities and spend within the home are following familiar patterns – they continue to experiment with digital services, enjoy quality family time, try new recipes, shop online and tackle DIY projects. Accordingly, spend has held or increased week-on-week on groceries and household necessities, streaming, news and other digital services, hardware and garden supplies, alcohol and health supplements.

Compared to other groups, 9Nation audiences continue to increase their use of streaming services and television, Herald and The Age readers are exercising more, Financial Review readers are working and driving more.

% who are doing activities ‘more than last week’

NOTE: For the best viewing experience on mobile, please view landscape.

% who spent more per category compared to last week

NOTE: For the best viewing experience on mobile, please view landscape.

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.