CONSUMER PULSE

We are living in uncertain times, but one thing is certain; the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys (conducted weekly) and deeper dive surveys (conducted monthly) with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 10 - commencing 25th May 2020

Headline Sentiments

“People around here have never taken the whole thing seriously”

“I feel paranoid when I go out, like everyone might have covid19”

Macro themes

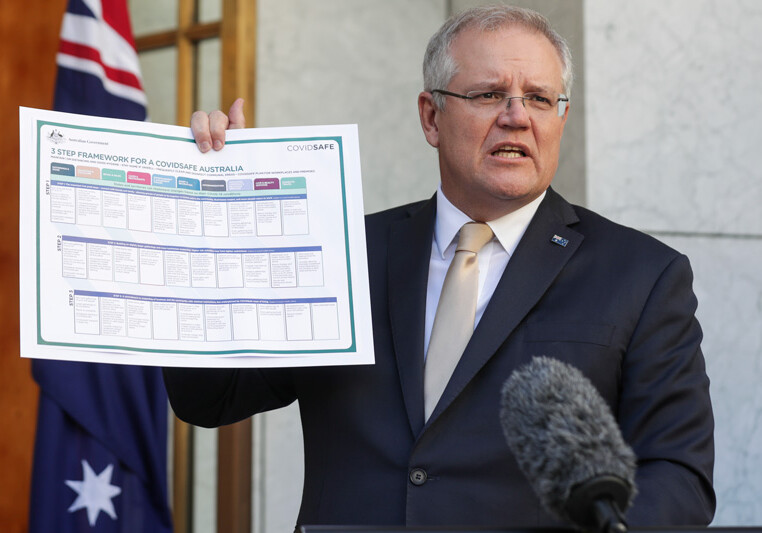

Mixed messages

Contradictory messages from government bodies are causing confusion, emphasising the continuing need for clear messaging across the board

Brand implication

Clarity of messaging is paramount to ensure consumers feel informed, respected and supported during the return to traditional interactions with your brand.

For or against

As restrictions continue to lift sentiments are divided - between those keen to return to normalcy and those apprehensive about a possible second wave.

Brand implication

Understanding consumers have different levels of comfort with the return to normality and ensuring your interactions/communications takes this into consideration will ensure you future-proof brand salience in the short to mid-term.

Wait and see

For many, continuing uncertainty about household finances and consequences of easing restrictions are leading them to proceed with caution, and make decisions carefully.

Brand implication

With consumers making more considered spending decisions, it has never been more important to make your brand memorable and relevant, looking to brand building rather than purely short term reactionary activity.

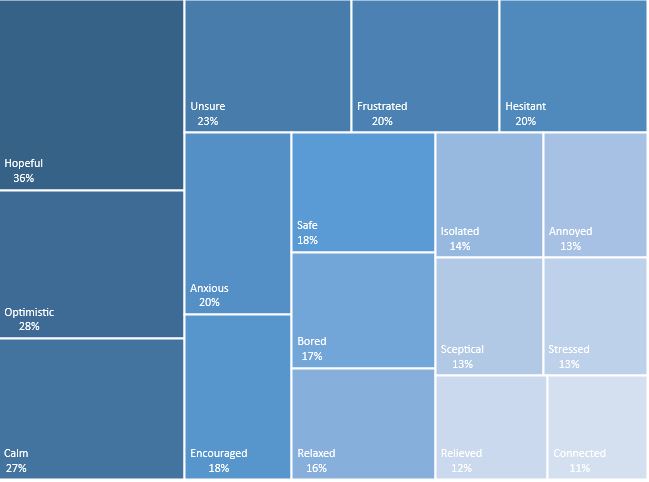

Mood tracker - positivity up, uncertainty lingers

This week sees another overall increase in positive emotions, hope and optimism are dominant. But although positive emotions continue to trend upward, easing restrictions are contributing to underlying currents of uncertainty and concern about safety, permeating attitudes and behaviour in several aspects of life.

Positive emotions trending up

NOTE: For the best viewing experience on mobile, please view landscape.

Negative emotions trending down

NOTE: For the best viewing experience on mobile, please view landscape.

Uncertainty ebbs and flows

NOTE: For the best viewing experience on mobile, please view landscape.

Safety not assured

NOTE: For the best viewing experience on mobile, please view landscape.

Changing concerns over time

Overall levels of concern have remained relatively stable over the past 4 weeks, but the nature of concerns is evolving over time. Worries about economic impacts are increasing, the easing of restrictions have seen a spike in concerns about ‘how others are behaving’. By contrast, audience concerns about personal health risks have declined (1 in 20 now concerned), but concerns about family members’ health are lingering (1 in 8 remain concerned). Throughout the crisis, audiences have remained concerned about societal impacts.

NOTE: For the best viewing experience on mobile, please view landscape.

Dining out

As restrictions ease for cafes, pubs and restaurants in many parts of the country, we explored attitudes to dining out. Across our audiences, some were more likely to have dined out ‘more’ than in the previous week - 10% of Financial Review readers, 7% of SMH / The Age readers and 6% of 9Nation audiences. In the comments, some were motivated by a return to normalcy, others to support local businesses.

Of those who had not, about 1 in 2 reported that restrictions either had not lifted or their local restaurants or cafes were not yet open. Around 1 in 3 hesitated due to concerns about health risks to themselves or others. In the comments, other audience hesitations related to the arrival of cold weather, uncertainty about how the rules work, a lack of confidence or readiness to take the step, a feeling that eating out is not yet a priority, a ‘wait and see’ attitude, or that they were happier with takeaway or meal kit options from restaurants or cafes.

Dining reservations: reasons for not eating out

NOTE: For the best viewing experience on mobile, please view landscape.

“I’m still not sure what the restrictions are and which cafes are open in my area. And how they will enforce social distancing”

“Getting too cold to go out at night, prefer to eat take away at home”

“Couldn’t be bothered pre-booking, or waiting in a queue, or committing to a min per person spend”

“I assume they'll all be full, so waiting for the newness of it to die down”

Sport at home

This week we again explored likely behaviours around televised sports. With current restrictions around pubs and clubs, the vast majority of sport fans predicted they will be staying in, most watching on their own or with family.

Settings for televised sport

NOTE: For the best viewing experience on mobile, please view landscape.

Likely company for televised sport

NOTE: For the best viewing experience on mobile, please view landscape.

Charity drives

Finally, given the importance of charity drives at this time of year we explored attitudes to charity appeals. Readers of the Sydney Morning Herald and The Age were most likely to be open to charity appeals (67%) and would consider donating to the right cause (42%), with similar proportions among Financial Review readers (64% open to appeals, 36% would donate to the right cause). Openness to appeals and intent to donate were lower among 9Nation audiences (51% open to appeals, 26% would donate to the right cause).

Finance content interests by age group

NOTE: For the best viewing experience on mobile, please view landscape.

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.