CONSUMER PULSE

We are living in uncertain times, but one thing is certain; the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys (conducted weekly) and deeper dive surveys (conducted monthly) with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 5 - commencing 13th April 2020

Headline Sentiments

- “I feel in limbo. We just have to sit tight.”

- “I’m trying virtual contact with family, doing classes on health and well-being.”

- “EVERYBODY in my suburb is renovating.”

Macro themes

Getting on with the job

Australians are accustomed to their COVID-19 living situation, and are finding a groove, armed with individual coping strategies and a sense of self-reliance.

Brand implication

Marketers can appeal to Australian values of resilience, independence, ingenuity and resourcefulness which are finding news forms and expressions.

Expanding horizons, at home

Australians are taking the opportunity to explore new content genres, media and technology to enhance their lives during this period and beyond.

Brand implication

It has never been more vital to explore a diverse range of content platforms to connect with consumers.

Justified spend

Australians are living more frugally, but also looking for ways to help the economy and the community.

Brand implication

Brands can highlight ways to ensure consumers' money goes further, encouraging spend with local businesses and support of key categories.

With thanks to The Lab & Nature Research COVID-19 Brand Navigator.

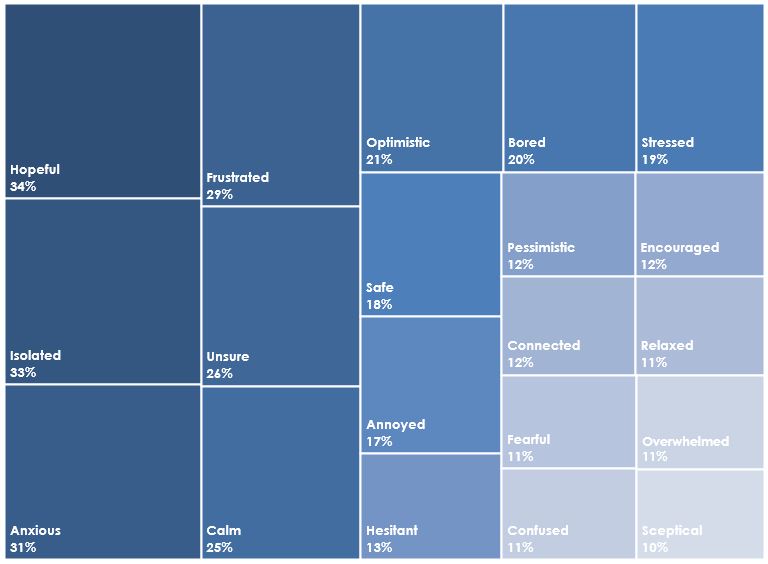

Mood tracker

Hope is the leading emotion this week. Negative emotions are trending down, positive emotions are trending up. The national mood has steadied with only 3 in 10 now feeling ‘extremely or very concerned’.

Mood trend

NOTE: For the best viewing experience on mobile, please view landscape.

A better future

As the situation develops some diverging audience sentiments are emerging. There those who want things to get ‘back to normal’, those who want to see material change as Australia moves forward.

Many are expressing a desire for more community-mindedness, a focus on the greater good and an increased sense of self-sufficiency in Australia.

- “A society that is more respectful of the impact of the individuals’ actions on the larger group.”

- “More care for the environment and each other.”

- “A more compassionate, connected and more 'human' experience. Better ongoing economic security for Australia, from Australia.”

- “A total reset is needed across the world and hopefully this is it.”

Exploring new content

Audiences are taking the opportunity to widen their horizons in terms of genre consumption - opening up new audiences and content opportunities for advertisers.

NOTE: For the best viewing experience on mobile, please view landscape.

Consumer spending

81% would like to do what they can to support the economy.

Nine audiences are consistently concerned about the economy and 59% are taking measures to save money. However some 4 in 5 are looking for ways to show support and there is openness to spend in key categories.

Shopping online for a home-based lifestyle

- 92% have shopped online in the past few weeks, more than 1 in 3 intend to increase online shopping in the next few weeks.

- Top categories for recent online purchases include household items (60% bought), home-delivered meals (43%), clothes and shoes (39%) and streaming services (21%). Other key growth categories include alcohol, skincare and personal care, health supplements, home office tech, electronics and appliances and books.

DIY projects

40% expressed interest in DIY projects during restrictions, with spend on hardware and gardening supplies, furniture and kitchen appliances growing accordingly.

Thinking locally

Some 90% would like to support their local stores and small businesses, recognising the adverse impact of this period on SMEs.

A time for trusted media

Media consumption has increased across platforms – 71% have significantly increased news and current affairs consumption, 63% are watching more linear television, 50% are using more streaming services.

80% trust Nine’s assets to bring them timely and accurate updates – whether via television, digital, print or radio.

Nine News is the most trusted television program for the latest and most accurate updates, and audiences place significantly more trust in Nine's online news sites (nine.com.au, smh.com.au, theage.com.au, afr.com etc) than in social media platforms (Facebook, YouTube, Google, Twitter).

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.