CONSUMER PULSE

We are living in uncertain times, but one thing is certain; the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys (conducted weekly) and deeper dive surveys (conducted monthly) with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 6 - commencing 20th April 2020

Headline Sentiments

“I think there are a lot of positive things to take from Corona.”

“I have realised more that family is so important. It always was but I was very blasé about it."

“I probably did not think too greatly about putting Australia first. Now I believe buying locally and employing people in this country for services is vital.”

“I’m concerned if things are relaxed too soon and there’s not enough testing that we open things up too quickly.”

Macro themes

Light ahead

With the flattening of the curve, Australians are beginning to relax and show guarded optimism about a post-COVID future, reflecting on the experience and considering their priorities going forward.

Brand implication

While there is light ahead, large scale unemployment and overall economic instability will not disappear overnight, and brands need to remain empathetic to these financial challenges to ensure they support their customers through a hopeful return to normality.

Ambiguity

Australians have mixed feelings about the way forward - impatient for restrictions to lift, cautious about reopening too soon, nervous about returning to public spaces.

Brand implication

Ambiguity can be overcome with clear concise communication. Communication which answers the diverse range of consumer concerns and questions. Supporting your customers through this transition can position your brand as a responsible corporate citizen and could have positive impacts on your bottom line.

All things Australian

The bonding experience of COVID, a renewed sense of community and desire to help the economy are combining to create a powerful sense of responsibility to help local and Australian businesses.

Brand implication

As was evident during recent grassroots Anzac Day commemorations, a sense of community and national unity is going to be a prevailing feeling in the months ahead. Brands should look to nation defining/connecting moments to highlight how their brand is supporting Australia's future.

With thanks to The Lab & Nature Research COVID-19 Brand Navigator.

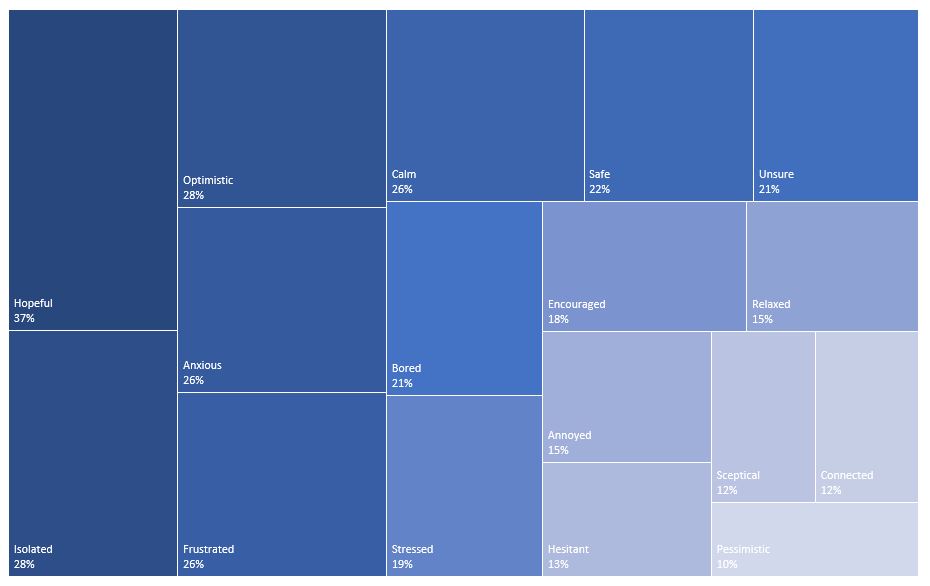

Mood tracker

This week levels of concern continue to slide, positive sentiments are on the rise and hope leads again. Audience concerns are mainly about the impact of the virus on society, communities and the economy, more so than direct, personal impacts.

Mood trend

NOTE: For the best viewing experience on mobile, please view landscape.

% who are ‘Very/Extremely Concerned’

NOTE: For the best viewing experience on mobile, please view landscape.

Activities and consumer spending

Nine audiences are spending their time and money in different ways during restrictions. Compared with last week, 9Nation audiences are watching more linear and streamed television, cooking, relaxing and online shopping.

Readers of The Sydney Morning Herald, The Age and the Financial Review are exploring more digital services, doing DIY projects, trying new recipes and doing online shopping.

Financial Review readers are also more likely to be working.

% who are doing activities ‘more than last week’

NOTE: For the best viewing experience on mobile, please view landscape.

Consumer spend

Financial Review readers continue to lead increases in spend. Consistent with their activities above, this week they are spending more on garden and hardware supplies, home office supplies and digital services, along with food deliveries, paid news and investments.

9Nation audiences are spending more on groceries, streaming services and household necessities, and readers of the Herald/The Age are most likely to have increased spend on alcohol.

% who spent more per category compared to last week

NOTE: For the best viewing experience on mobile, please view landscape.

Changing values

When asked about aspects of life audiences now consider to be more important, emergent themes were about the importance of supporting Australian businesses, appreciating the simple things, reconnecting with the people who matter, adapting to change and acting out of kindness and for the greater good.

% who consider aspects more important now than pre-COVID

NOTE: For the best viewing experience on mobile, please view landscape.

Looking past COVID

Finally, when asked to envisage life post-restrictions, Nine audiences are mostly looking forward to becoming more social creatures again – seeing the people who matter, eating out and using social activities and venues. There were again some differences with 9Nation audiences most likely to look forward to shopping normally, having kids back at school or daycare and generally living with less stress and anxiety, while readers of the Financial Review are looking forward to returning to work, exercise and the gym.

% most looking forward to post-COVID restrictions

NOTE: For the best viewing experience on mobile, please view landscape.

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.