CONSUMER PULSE

We are living in uncertain times, but one thing is certain, the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys conducted weekly with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 4 - commencing 5th April 2020

Headline Sentiments

- “I’m concerned about the impact on people I love, both financial and emotional”

- “It's hard to sleep without the regular exercise”

- “We will overcome this, but what will the world look like?”

Macro themes

Changing habits and behaviours

Consumers are expanding their horizons and trying new things, many for the first time. Circumstance is driving uptake in technology platforms, changes in media behaviours, experimentation with different brands and content.

Brand implication

brands have the opportunities to build new relationships and embed themselves in consumers' lives for the long term.

Rethinking values

Many are taking time to reflect on the meaning of recent times and some of the positive outcomes, with simplicity, flexibility and community growing in importance.

Brand implication

Brands have an opportunity to be part of a different, brighter future, by continuing to listen closely to consumers as values and sentiments evolve.

Physical health in focus

For many, survivalism and adherence to isolation measures have been at the expense of physical health and wellbeing, with the effects starting to become apparent.

Brand implication

There are opportunities to provide meaningful help and value to consumers via physical health inspiration – whether it’s about routines, challenges, freedom, self-care, connection with others, mental wellbeing – the possibilities are broad.

With thanks to The Lab & Nature Research COVID-19 Brand Navigator.

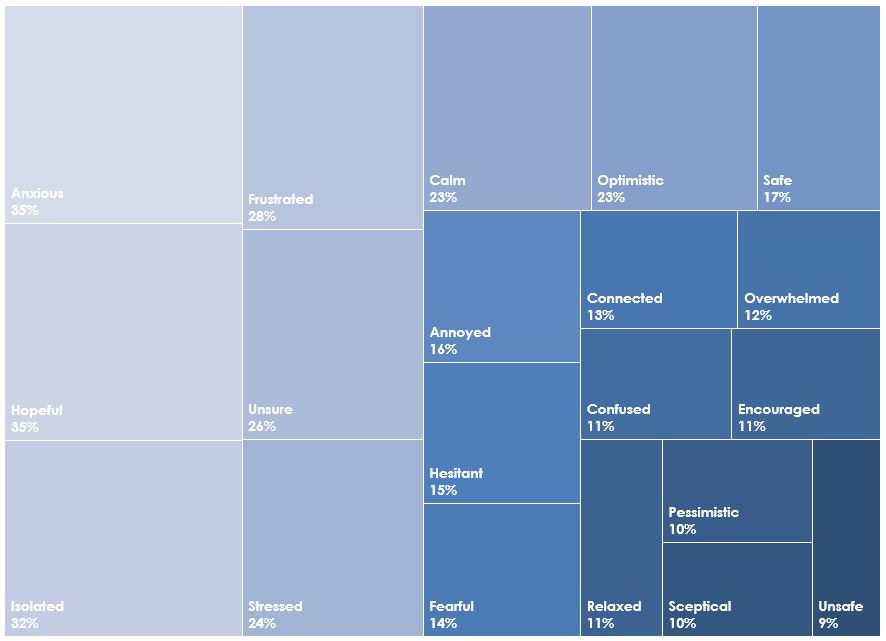

Mood tracker

The mood overall is starting to lift; changes over 3 weeks show some of the more extreme negative emotions dissipating and positive and reflective feelings emerging. However audiences continue to wrestle with mixed emotions – isolation, anxiety and frustration meet hope, calm and optimism.

Changes in mood

NOTE: For the best viewing experience on mobile, please view landscape.

Audience concerns

Concern tracker

Audience concerns have been allayed further this week with only one-third of audiences now feeling ‘extremely or very concerned’.

Issues of greatest concern:

Topline tracker results suggest audience worries are unchanging each week. The top concerns are again about impacts for family, communities, society and the economy. However in open-ended commentary, audiences suggest new and emerging concerns about Australia’s response to the crisis.

Each week audiences express concerns about their immediate family members – especially those working at the frontline, living overseas, experiencing loss of jobs and income, having schooling interrupted, or needing medical help or care.

“My partner who is a nurse being in danger”

“My pregnant daughter & her family in the US”

There is also ongoing concern about the impact on vulnerable or at-risk groups – the elderly or unwell, casual and low-income households, migrant workers, international students in Australia, and those in developing countries without adequate resources. And there is annoyance about people flouting the rules or not doing their part -

“I’m concerned about those who will fall between the cracks”

Emerging this week are concerns about future impacts of government decisions on democracy, the economy and environment. Audience sentiments suggest a tension between the desire to return to normalcy and wanting a new, better way forward –

“I’m concerned about the risk of not learning the lessons, or of economic and social conservatives pushing the idea of "getting back to normal". Normal was not working. We must move to a new way of being on this planet”

“[I’m concerned about] Government decisions being made without scrutiny, particularly about environmental issues”

“[I’m concerned about] The disproportional use of power by governments”.

Impacts on life

The common impacts felt by audiences are consistent with last week – social distancing and isolation, cancellation of travel and events, closures of social and public venues and inability to work are top of the list.

Changes in results over a fortnight suggest that loss of social contact and impacts on physical health are starting to be more acutely felt.

NOTE: For the best viewing experience on mobile, please view landscape.

Changes in impacts Weeks 2 - 4

NOTE: For the best viewing experience on mobile, please view landscape.

Activities audiences are doing more or less of – in the last week

Compared with the previous week, audiences are exploring more media choices – finding alternatives for activities previously done in person, using more streaming services and watching more TV. They are making more home-cooked meals and doing more online shopping. 9Nation, SMH and The Age audiences are relaxing more while Financial Review readers are spending more quality time with family (but relaxing less). The loss of physical exercise features again here as a major change.

NOTE: For the best viewing experience on mobile, please view landscape.

Impact on consumer spending

After an initial burst of panic buying, consumer spend is starting to settle among 9Nation, SMH and The Age audiences. The graph below shows that most spent ‘the same as last week’ across a range of categories (groceries continue to demand higher spend).

NOTE: For the best viewing experience on mobile, please view landscape.

By contrast, Financial Review readers’ buying shows a general upward trend. Spend is growing week-on-week in key categories including hardware and garden supplies, food deliveries, news subscriptions, digital services (other than news or entertainment e.g. fitness) and fashion, shoes and accessories. Spend on groceries and other household necessities has fluctuated, as has spend on investments.

NOTE: For the best viewing experience on mobile, please view landscape.

Marketing messages - practical and positive

This week Nine’s audiences are again interested in practical information from organisations e.g. changes to trading hours, delivery arrangements, with increased interest in discounts and concessions since last week. About a third of audiences are also showing interest in inspiration ideas to help make life better, news about socially responsible initiatives and other generally positive news. Examples include how to boost immunity or wellness, how brands are supporting suppliers and medical workers, and how brands are improving their ecological impacts. Audiences are clear that they are not receptive to vague communications – “Stop sending me meaningless messages about how "we are here to care!”.

NOTE: For the best viewing experience on mobile, please view landscape.

A different Easter

Audiences expressed sadness and resignation about missing their usual Easter traditions – whether these are spending time with family or friends, going to church or Mass, escaping to holiday houses, going camping or boating or out for special meals. Many were looking for silver linings by maintaining some traditions at home, planning video or phone calls to connect with others, watching live-streamed religious services, dropping off meals or Easter treats on doorsteps, focusing on projects in the home, garden or shed, or using the time for rest and relaxation.

“No family, no travel for Easter. Very sad. The only thing the same will be having an Easter egg hunt”

“We won’t be able to go camping as a family, or go to church. We also won’t have enough money to have anything beyond essentials”

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.