State of the

Nation

In a new series from Nine, State of the Nation dissects the state of play across several key categories challenging marketers right now. Each sector update provides a platform to voice opinion among key industry players, share insights and ideas derived from Nine’s audience intelligence, and pave a way forward to help brands navigate the future.

State of the Nation

In a new series from Nine, State of the Nation dissects the state of play across several key categories challenging marketers right now. Each sector update provides a platform to voice opinion among key industry players, share insights and ideas derived from Nine’s audience intelligence, and pave a way forward to help brands navigate the future.

In part two of this new series we explore the State of the Nation through the lens of Finance – a key industry that has experienced transformation in the wake of the global pandemic, and will continue to do so in the months, and years to come.

Recap on State of the Nation: Finance LIVE from Sydney CBD

Finance behaviours, trends and insights from Crowd.DNA and Nine

Industry Panel - CBA, Judo Bank, Humm Group, and finance commentator, Effie Zahos

Turn consumer desire into action

New brand opportunities and inspiration

What you need to know

What you need to know

Recent events have

spurred Australians

to take greater control

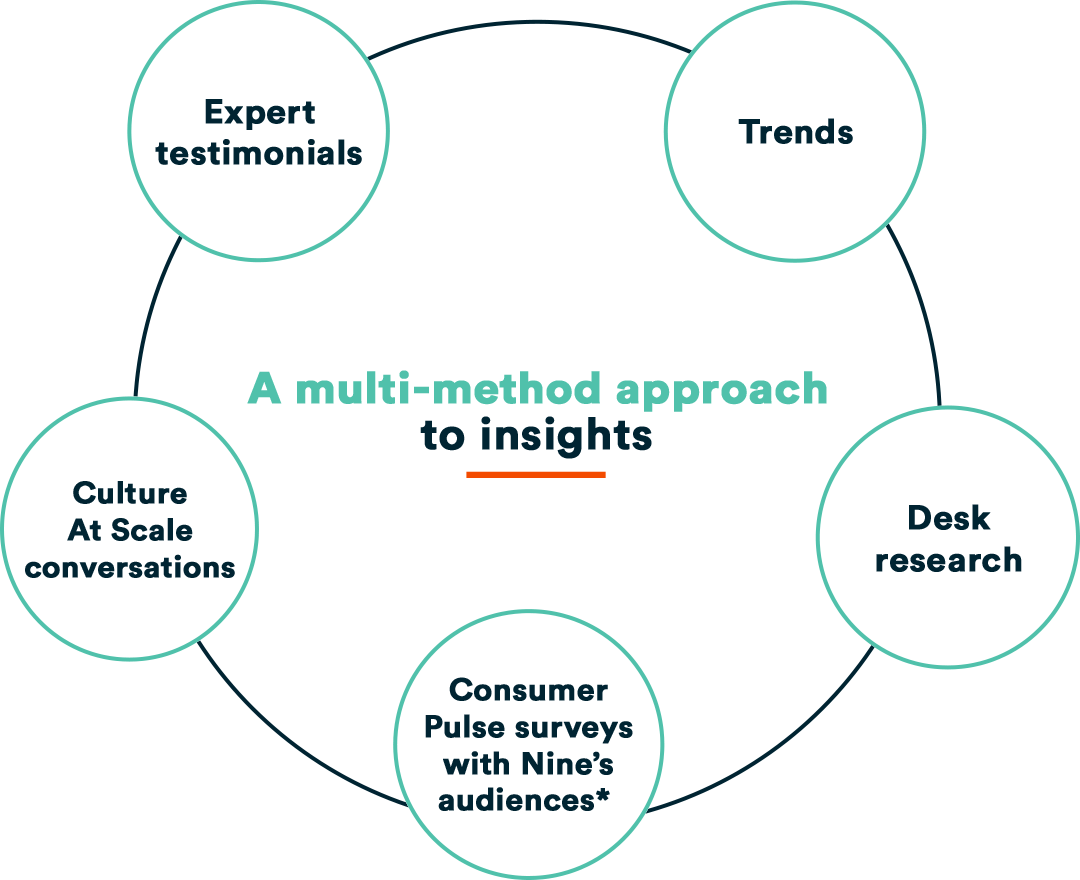

We partnered with cultural insights and strategy consultancy Crowd.DNA on a multi-pronged approach, leveraging primary and secondary research and culture-at-scale conversations. We focused on two distinct target audiences - consumers and small businesses.

Recent events have

spurred Australians

to take greater control

We partnered with cultural insights and strategy consultancy Crowd.DNA on a multi-pronged approach, leveraging primary and secondary research and culture-at-scale conversations. We focused on two distinct target audiences - consumers and small businesses.

*Oct '20–May '21, n=1,900+

3 dominant themes

THEME 1

Flexible Futures

Help consumers navigate through flexible futures, shifting milestones, lifestyle changes, ways to grow wealth with good information, trusted sources and trusted environments.

64%

of audiences have re-evaluated

work-life priorities

84%

of renters say home ownership feels increasingly out of reach

46%

of small business owners

expect their business to be

better off by end of year

64%

of audiences have re-evaluated work-life priorities

84%

of renters say home ownership feels increasingly out of reach

46%

of small business owners expect their business to be better off by end of year

THEME 2

People Power

Help them take control of their own destinies, feel safe while having the confidence to make decisions, dial down caution and dial up optimism.

1 in 3

audiences are more interested in their finances vs pre-COVID times

+355%

increase in conversation around sustainable banking & finance

+136%

interest in crypto conversation

THEME 2

People Power

Help them take control of their own destinies, feel safe while having the confidence to make decisions, dial down caution and dial up optimism.

1 in 3

audiences are more interested in their finances vs pre-COVID times

+355%

increase in conversation around sustainable banking & finance

+136%

interest in crypto conversation

THEME 3

Good Decisions

Help them feel more confident, and make good decisions for themselves as individuals and collectively as a society, and for their businesses.

43%

of women have lower confidence in their financial literacy skills

31%

of audiences say they most need help growing long-term wealth

54%

of audeinces value financial providers that are Australian-owned or operated

43%

of women have lower confidence in their financial literacy skills

31%

of audiences say they most need help growing long-term wealth

54%

of audiences value financial providers that are Australian-owned or operated

Sources: Nine’s Consumer Pulse Oct – May n=1,900+, Crowd DNA Culture At Scale conversations

What this means for brands

Through our research, we identified five key take-outs to help build confidence to move forward:

1

Build financial literacy and confidence

2

Speak to specific needs and interests

3

Give help and hope to SMEs

4

Make it manageable

5

Speak to consumer values

Looking to connect with audiences about their finances?

Looking to connect with audiences about their finances?

The Nine

Finance network

Across print, digital, television and radio, Nine provides you with greatest network to reach and engage both consumers and small businesses around their finance needs.

The Nine Finance Network

Across print, digital, television and radio, Nine provides you with greatest network to reach and engage both consumers and small businesses around their finance needs.

The Money section is the place for authoritative advice on your financial health and wellbeing. Whether it be retirement planning, running a self-managed super fund, or buying a home. Entrepreneur showcases stories from small business owners on the highs and lows of running a business, plus advice from some of Australia’s most successful entrepreneurs.

782,000

Small business owners

1.5 million

Home loan intenders

4.3 million

Investors

782,000

Small business owners

1.5 million

Home loan intenders

4.3 million

Investors

Whether you are starting from scratch or managing your established portfolio, The Financial Review has you covered. Wealth Generation helps young professionals to begin their investment journey. Smart Investor is focused on wealth creation and protection, be it shares, property, fixed interest, specialist investment or SMSFs.

3.1 million

Ambitious and influential readers every month

1.5 million

Emerging leaders under 44 – Wealth Generation

50%

More likely to be high net worth investors

3.1 million

Ambitious and influential readers every month

1.5 million

Emerging leaders under 44 – Wealth Generation

50%

More likely to be high net worth investors

From guides for those getting started in finance to strategies and tips for those building their fortune, 9Finance has something for everyone. At 9Finance you’ll find a lighter take on the finance and business news you feel you should know, and tips and tricks to help you understand your money better.

Money News with Brooke Corte is the most respected business program on radio, with a weekly cumulative audience reach of 77,000. Corte has been a business journalist for nearly 20 years and has led the coverage and analysis of the biggest business and economic stories for a decade. She presents Money News Monday-Thursday from 7.00pm to 8.00pm (AEST).

Access premium TV content across the Nine Network to contextually align your brand to relevant News, Sport, Entertainment and Lifestyle programming.

Access premium TV content across the Nine Network to contextually align your brand to relevant News, Sport, Entertainment and Lifestyle programming.

Through our data,

we reach valuable

audiences at scale

Find your target audiences and your customers with Nine's powerful, addressable marketing platform. Connect with 11 million Australians who have signed in to 9Now, Domain, AFR, SMH, The Age, Brisbane Times and WA Today – all using the Nine user ID as our identifier.

Through our data, we reach valuable audiences at scale

Across print, digital, television and radio, Nine provides you with greatest network to reach and engage both consumers and small businesses around their finance needs.

Target credit card, home loan and investing intenders through Nine’s partnership with Australia’s largest credit bureau, Equifax.

Engage SMEs, personal wealth accumulators and homebuyers with 9Tribes, Nine’s unique audience segmentation

Create your own custom audiences using your own customer data – activate, suppress, or find lookalikes of your current customers

Ways in for brands

Life is defined by the

decisions you make

However small or big, whether it's that "set and forget" with your super fund, withdrawing $20,000 out of your super fund, putting more in earlier or retiring early, your retirement life is defined by the decisions you make while working. A content-led series across all Nine platforms: print, digital, radio and TV. First-person stories, interviewed by our commercial editors. An opportunity to surround-sound the community with first-person lessons of how to retire well and improve financial performance. Content written and shared across our network by one of our financial partners.

The GREAT Switch

Using the trusted expertise of the Money team, the SMH and The Age will inspire Australians over a 12-week period every Wednesday to switch for a better deal. To review their current providers on their big outgoings, mortgage, utility bills, insurances, etc. Creating a groundswell to get a better deal and being open to change to make a switch. “Switching” inspiration to run across print, digital, radio and TV using Money talent. A perfect environment for any financial product or utility to promote their offering.

Entrepreneur

Entrepreneur will launch with a new dedicated print section on Tuesdays, a new digital section in business, plus a podcast series - founders stories. The last 12 months have shown us that Australia’s entrepreneurial spirit is stronger than it has ever been, with amazing stories of innovation, resilience, and hard work. Being an entrepreneur is not defined by how many people you employ or how much money your company makes. It is a state of mind. It is something that stays with you know matter how much you and your business grows. The SMH & The Age are committed to supporting Australia’s SME’s and Entrepreneurs as they grow their business and continue to invest in more content dedicated to helping and supporting them on their journey.

Here's a few ways we have helped our finance partners to

meaningfully connect with Australians

NRMA Insurance | The Sydney Morning Herald

Jacaranda Financial Planning | Nine Radio

ANZ | Powered Studios

For further information, contact your Nine representative, or complete the form below. A member of the team will be in touch.