CONSUMER PULSE

We are living in uncertain times, but one thing is certain; the better we understand audiences, the better we can serve their needs and wants as marketers. In response to the COVID-19 crisis, Nine has launched a weekly consumer sentiment poll to understand how we can help brands connect with our audiences in 2020.

Nine. Where Australia Connects.

Methodology

Consumer Pulse is undertaken via short online surveys (conducted weekly) and deeper dive surveys (conducted monthly) with Nine’s audiences - across linear television, 9Now and digital properties nine.com.au (and network sites), plus readers of news mastheads The Sydney Morning Herald, The Age and The Australian Financial Review (print + digital).

Capturing the mood

Week 7 - commencing 27th April 2020

Headline Sentiments

“I feel cautiously optimistic and patient”

“I feel safe for now but am very worried about pressure to resume going to my workplace rather than continuing to work from home”

“People trying to work from home and home school is absurd”

“Totally Zoomed-out!”

Macro themes

Cautious Optimism

The mood in Australia is on the up, people are looking forward to normality returning but are also cautious and concerned about Australia ‘opening up’ too quickly.

Brand implication

Brands should continue to monitor the mood, promoting elements of normality or showing their responsiveness as appropriate.

Economic Tension

Consumers are aware the economy needs to regain momentum and open to the right marketing messages, but financial pressures and uncertainties remain present in spending decisions.

Brand implication

Some brands can play in the territory of ‘justified spend’, others may need to continue with normal brand-building activity until greater consumer confidence returns.

Feeling Stretched

Working families are continuing to juggle the pressures of employment and home-schooling.

Brand implication

Brands can play a valuable role in helping to make life easier – acknowledging the challenge, smoothing the way or offering relief.

Mood tracker - positivity on the rise

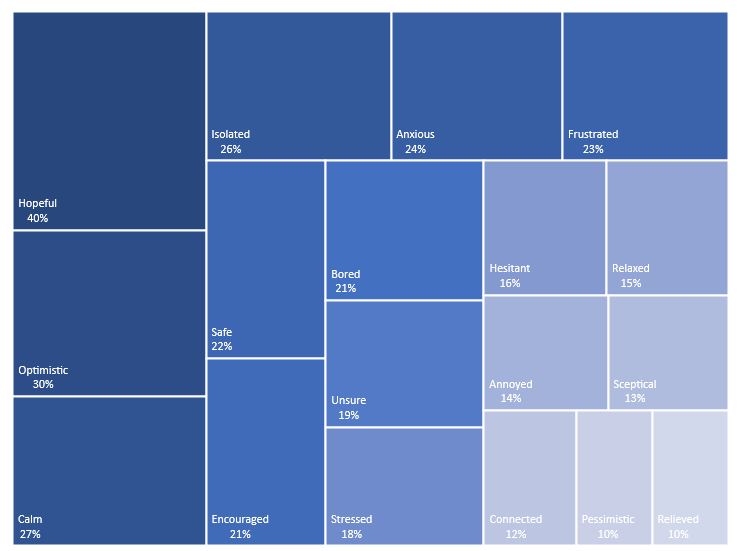

Hope is taking hold and positivity has momentum. This week the three leading emotions are hope (40%), optimism (30%) and calm (27%). Fewer than 1 in 5 are now feeling ‘very / extremely concerned’, and lingering concerns remain focused on the impact of the virus and restrictions on communities, society and the economy.

% who are ‘Very/Extremely Concerned’

NOTE: For the best viewing experience on mobile, please view landscape.

Contrasting experiences of COVID: Mood trends by age group

Across Nine’s audiences, positive and negative emotions are now almost equal in measure. However there are differences between age groups:

- 18-34s have had a tumultuous journey; at the height of the crisis this group reported significantly more negative emotions and fewer positive emotions, but are now gaining positive momentum at a faster rate than other groups

- Over 55s were least worried to begin with and have passed an inflection point, with positive emotions outweighing the negative for two consecutive weeks

- 35-54s had maintained a steady middle ground between other age groups but are now least likely to be reporting positive emotions, possibly as a result of juggling competing responsibilities of work and family at home

Mood trend overall

NOTE: For the best viewing experience on mobile, please view landscape.

Mood trend by age group

NOTE: For the best viewing experience on mobile, please view landscape.

Mixed emotions about restrictions lifting

Audiences are in two minds about a partial lifting of restrictions, feeling both cautious and hopeful, concerned and relieved, happy and anxious. Very few are feeling indifferent. In open-ended comments, some express delight, gratitude and calm, others conveyed concern about the behaviours of others, suspicion about government motives for opening up, worry that testing is not widespread or conclusive enough to warrant it, or anxiety about restrictions returning.

“Terrific, steady as she goes!”

“Quite worried as I don’t believe it is safe yet”

“I don't want it to be premature as I can't go through this again”

“I’m concerned that people will be irresponsible”

“Accepting, based on my trust that we are in good hands”

% of emotions for lifting of COVID restrictions

NOTE: For the best viewing experience on mobile, please view landscape.

Activities and consumer spending

This week Nine’s audiences are spending their time and money in similar ways to last week - more time in the kitchen, on DIY projects, online shopping and digital media.

Accordingly their spend is more likely to be directed toward groceries and alcohol, hardware and garden supplies, streaming and in-home entertainment and food deliveries.

Financial Review readers continue to increase their spend on investments. This will be monitored in the coming weeks as partial restrictions begin to roll out in some parts of the country.

% who are doing activities ‘more than last week’

NOTE: For the best viewing experience on mobile, please view landscape.

% who spent more per category compared to last week

NOTE: For the best viewing experience on mobile, please view landscape.

Marketing messages and getting the tone right

Nine’s audiences acknowledge the importance of getting the economy moving and are open to the right marketing messages. Fewer than 5% think ‘businesses shouldn’t be advertising at this time’.

Marketing messages audiences are most receptive to:

- Practical messages e.g. with specific, useful, factual information, discounts and concessions, news about initiatives that are supporting staff, ways they are helping during the crisis

- Positive messages e.g. inspiration and ideas to make life better, general positive news, light-hearted or fun messages, celebration for exceptional efforts of staff

- To a lesser extent, business as usual messages about business beyond COVID-19 or their normal communications

Audiences are less receptive to personalised communications and general reassurances that ‘we’re here to help’.

Around one-fifth of Nine’s audiences say they would prefer ‘no more COVID-19 messaging’ – highest among Financial Review readers (26%), lower among readers of SMH / The Age (18%) and 9Nation audiences (16%).

% who are open to type of marketing messages

NOTE: For the best viewing experience on mobile, please view landscape.

Tone: normal voice, appropriate to setting and context

The tone of messaging is also a major consideration at the moment. Across the board, Nine’s audiences are most receptive to brands communicating:

- In their usual ‘voice’, as they normally would

- In a way that fits the platform or setting e.g. TV, radio, newspaper etc

- In a way that feels contextually relevant to the content e.g. serious news, lighter content etc

They are less open to ‘blanket rules’ on communications in a caring, light-hearted or serious tone, with some differences between audiences:

- 9Nation audiences are more open to communications in a caring, sensitive or light-hearted tone

- Readers of SMH / The Age would like to see less frequent messaging about COVID-19, and think the tone should reflect the seriousness of the times.

% who agree about tone of messaging

NOTE: For the best viewing experience on mobile, please view landscape.

Audience sentiments on marketing messages and tone

“I like that some ads have adapted and acknowledge the times we are in”

“Most Australians can detect confected concern a mile off. So just in their normal voice”

“People are overwhelmed and flooded with the drone of the pandemic. Short, sharp "We Saw, We Changed, We have Fixed" solutions to be offered”

“I'm getting kind of tired of the emails from businesses saying they're "here to help". I get why they're doing it, but when you're getting 18 or so a day, it's a bit much”

“SHOWING how their product will help 'us get through this together”

Discover how Nine’s audience consumption has changed

From radio to television, our audiences are choosing trusted news and lifestyle brands to stay informed and entertained.

Take a closer look with our audience consumption report.