Nine’s thought leadership and insights series, State of the Nation, dissects the state of play across key categories challenging marketers right now.

Each sector update provides a platform to voice opinion among key industry players, share insights and ideas derived from Nine’s audience intelligence, and pave a way forward to help brands navigate the future.

There is a growing cohort of young Australians who are finding new pathways to manage their money and grow their wealth. We will explore their broader financial needs and behaviours, delve deeper into new pathways to wealth, look to unearth emerging financial trends and investigate the adoption of new platforms to help them make their future financial decisions.

Recap on State of the Nation Finance live stream event

Full Event Stream

Research Debrief

Panel Session

Commercial Initiatives

The Research

A multi-method approach to insights

Desk Research

Consumer Pulse surveys with Nine's audiences*

Quantitative exploration of ‘wealth mindset’ individuals under 40

Cultural Intelligence with Lab AI

Qualitative interviews with leading-edge, wealth-minded individuals under 40

The current state of play

Australia’s economic outlook…

Inflation impacting finances

Weaker share market

Cost of living pressures

Supply chain disruption

Despite the disruption of COVID-19, Australia’s household wealth has surged.

According to the Australian Bureau of Statistics(ABS), household wealth has skyrocketed by

$518 billion

Wealth per person hit

$492,055

and total household wealth hit

$12 trillion

- both records

We are at the cusp of the largest intergenerational wealth transfer in history

In Australia, millennials will inherit

$3.5 trillion over the next 20 years

an average of $320,000 per person

Source: Firstlinks Nov '20

So who are the next wave of wealth?

2 in 3 Australians aged 18-39 have an investment portfolio

of 18-39 year-olds have investments

15%

have directly owned shares

14%

own real estate outside of their own home

10%

have a cash management account or trust

'The next wave of wealth' of under 40's is:

More diverse

51%

Male

49%

Female

compared to 60% males / 40% females for those aged 40+

More values-orientated:

58%

generally have progressive views

higher than those aged between 40-54 (50%) and 55+ (34%)

92%

say it is important to be ambitious

8pp higher than those aged 40+

Source: Nielsen CMV Survey, Mar ‘21 - Feb ‘22

They are more diverse, more values-oriented, and success is important to them (success = passion)

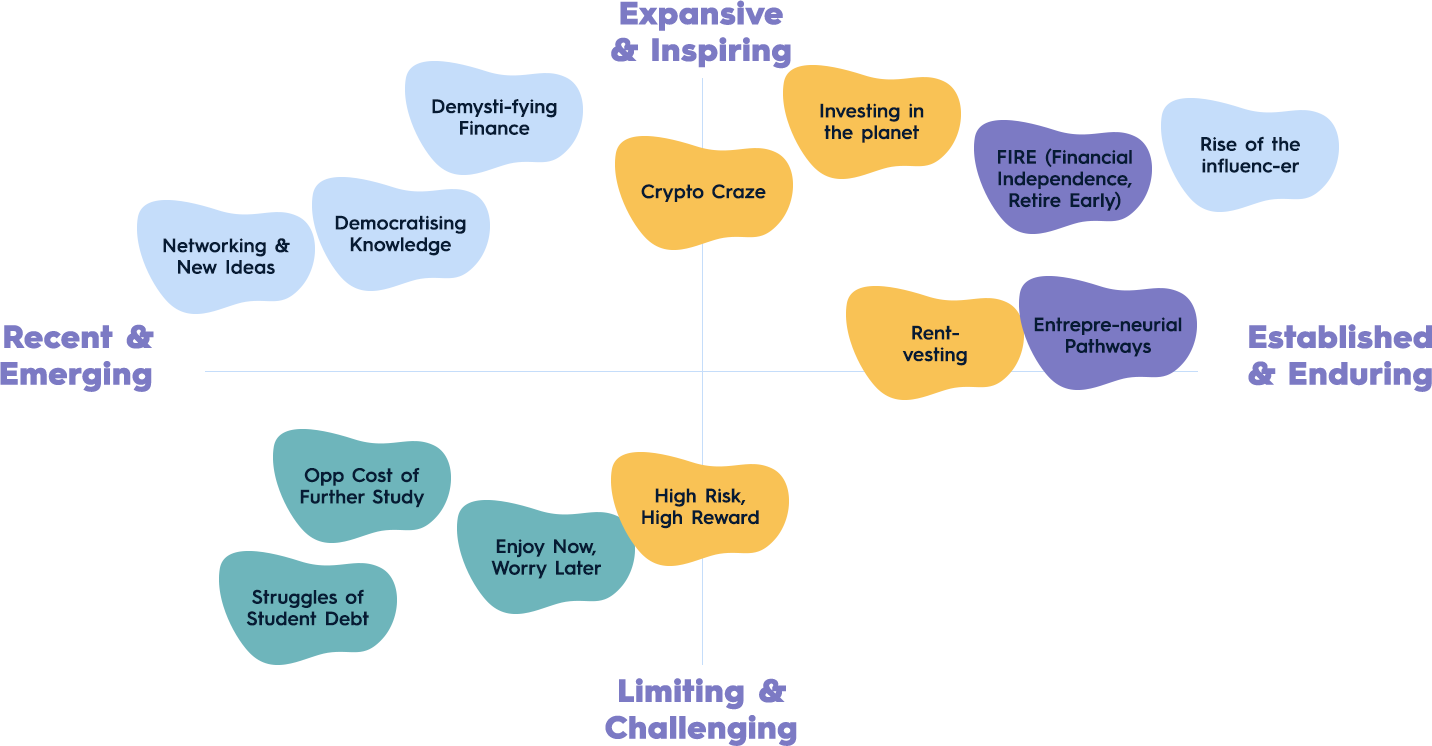

Decoding the Landscape

Mapping salient cultural conversations on wealth and young people in Australia

Key

How to engage the new wave of wealth

'The New Wave of Wealth' is driven by passion

Financial providers will need to promote products and services that talk to evolving priorities and new ways in which they can offer advice or assistance

They seek financial communities and ethical practices

How they manage their finances aligns with the broader interests – and comes with the expectation of a community mindset that reflects their values

They want information instantly and easily accessible

To grow with the new wave, financial institutions need to play by the new rules of engagement through a range of platforms – from the most trusted and established sources to aligning with credible new perspectives

They’re less risk-averse

With more emerging and experimental paths to grow wealth there is an opportunity for brands to own the gap between innovation and trusted investment

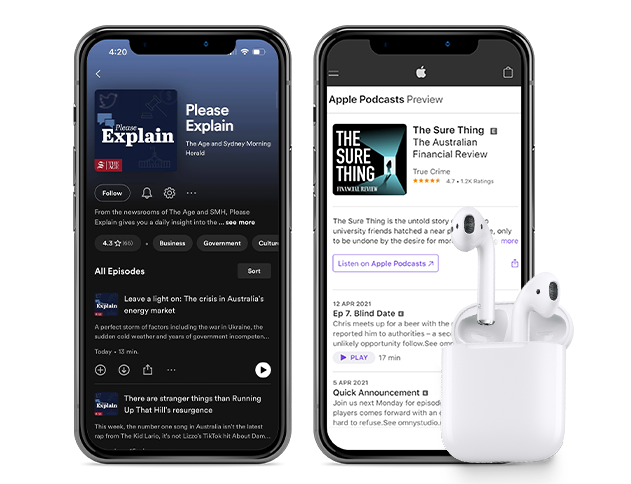

Our readers are engaging with our finance brands across multiple dynamic platforms

Digital

Podcasts

EDMs

Activations

9Honey

Utilise the power of Nine's data to reach an audience at different stages of their finance journey

Socially Aware Change Agents

Premium Socially Progressive

Rising Wealth

Informed Professionals

We have at our disposal Australia’s largest data footprint – almost 20 million registered users. We can help you reach your core audiences through Nine’s unique consumer segmentation, 9Tribes, wherever they are on their financial journey to wealth, or by surfacing your messaging in relevant content via Contexti targeting. Nine’s data strategy allows you to maximise the efficiency and effectiveness of your media buying, delivering the right message to the right person at the right time, in a premium content environment.

A wealth of new opportunities

Ways in for brands

Budgeting

New Couples Budgeting Series

Money with Jess

Jessica Irvine Super Brand

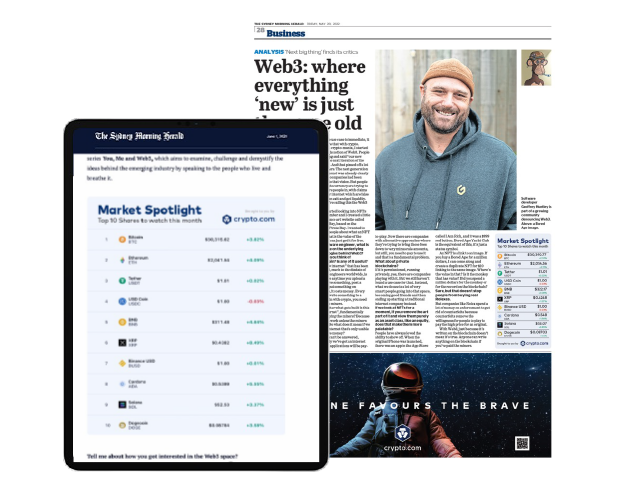

Market Spotlight

Editorial Integration into Investing | Shares | Bitcoin

Super Series

New Editorial Educational Series

AFR/ Wealth Generation

New Podcast and Content